corporate tax increase effects

The option would increase revenues by 96 billion from. In our new book Options for Reforming Americas Tax Code 20 we illustrate the economic distributional and revenue trade-offs of 70 tax changes including President Bidens.

Biden Corporate Tax Increase Details Analysis Tax Foundation

That will see the new state pension currently worth.

. As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. But Republicans are already. One of the biggest ways that corporate income taxes may impact a corporation or company is when corporate income.

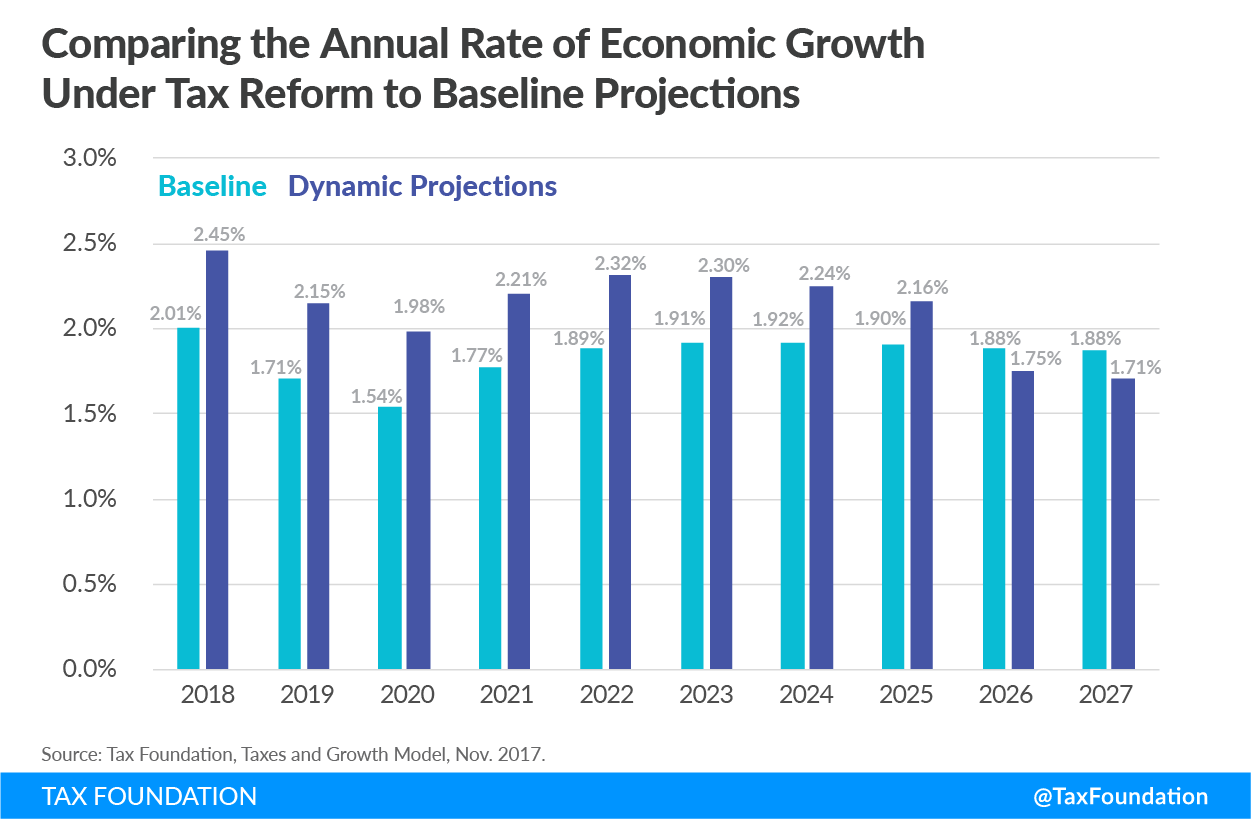

Using 1970-2007 data from the United States a Tax Foundation. The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35. The issue of taxation is one of the key subjects that draw the attention of both policymakers.

111 Economic Effects of the Corporate. As a result of these taxes the top 1 would see a reduction in after-tax income of 142 taxpayers between the 95th. 20 hours agoAfter months of uncertainty the chancellor confirmed that the state pension would go up by 101 to match inflation.

The Effects of Corporate Tax Rate on the Firm Performance. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people. The cut means millions of people will pay more tax including pensioners self-employed and business owners who pay themselves in dividends.

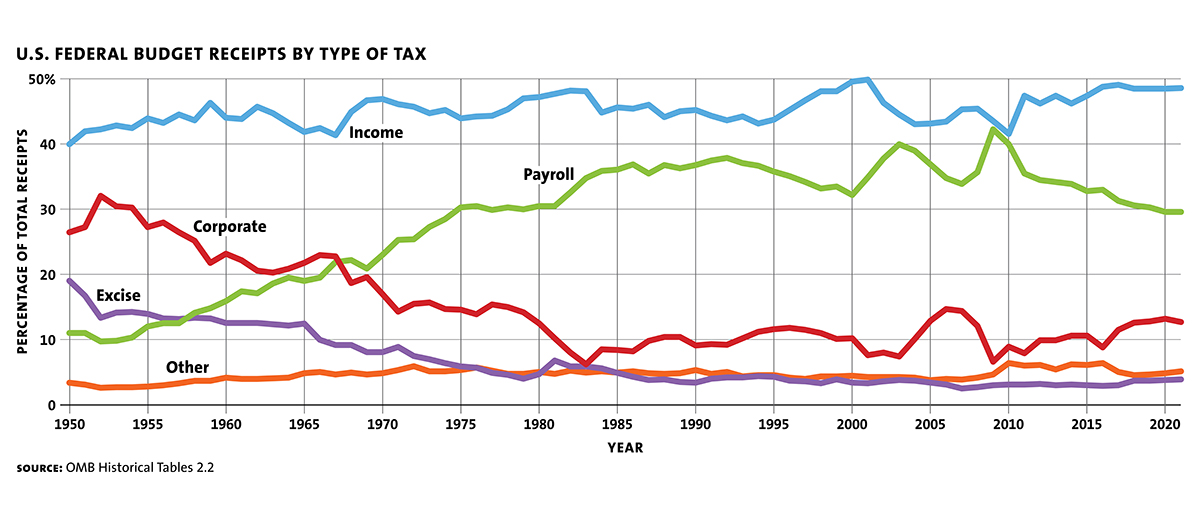

PWBM analyzed an increase in the corporate income tax rate to 28 percent from its current level of 21 percent as part of the Biden presidential campaign. Social Security payroll tax to earnings over 400000. Corporate Income Taxes and Corporate Hiring Decisions.

Ment of the firm will increase its shareholders assets by undertaking the project as long as the firms value increases by at least 600000 not 1. Effects on the Budget. Corporate tax rate to rise from 21 to 28 in order to help pay for his 25 trillion infrastructure plan but tax experts are divided as to.

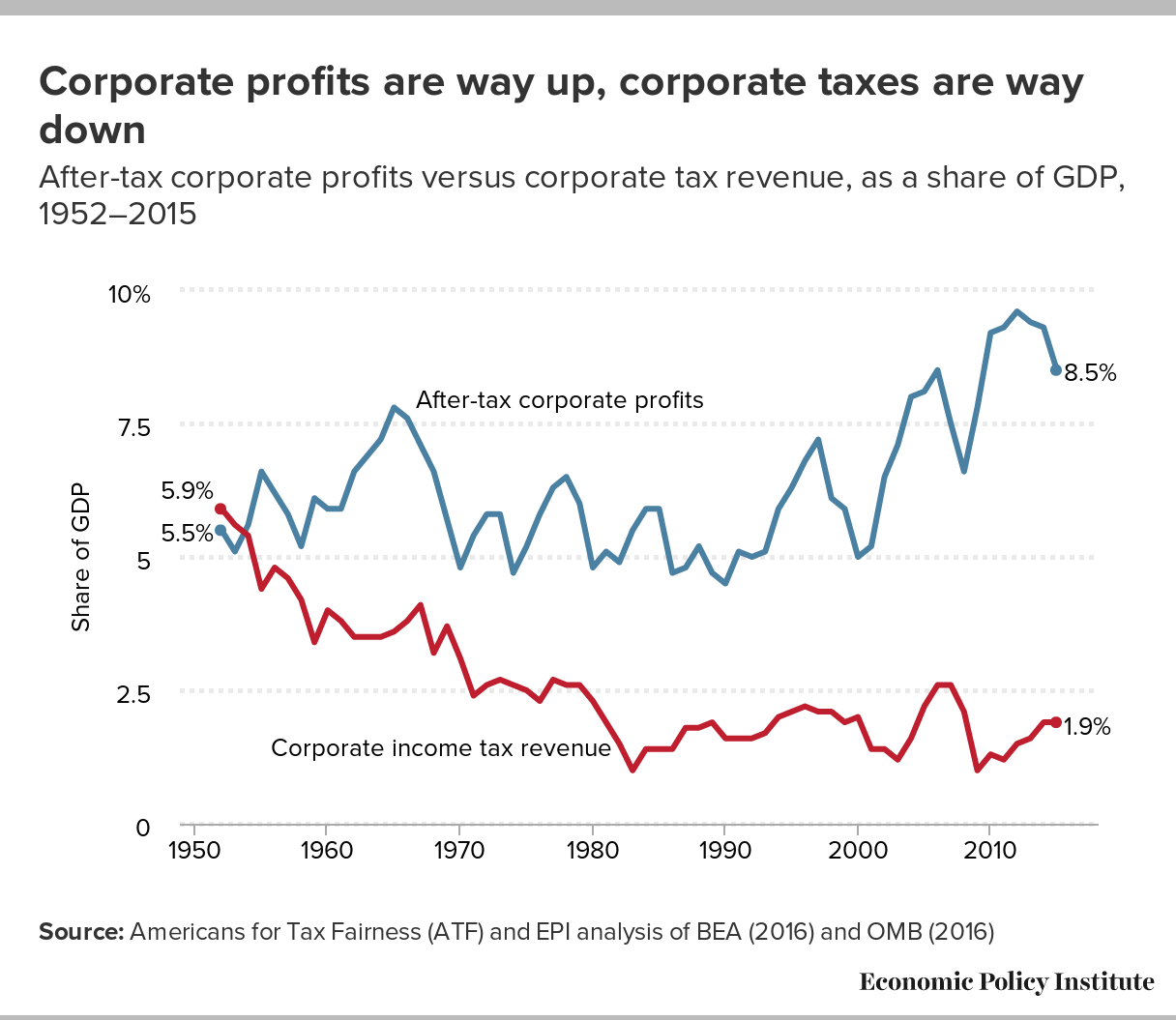

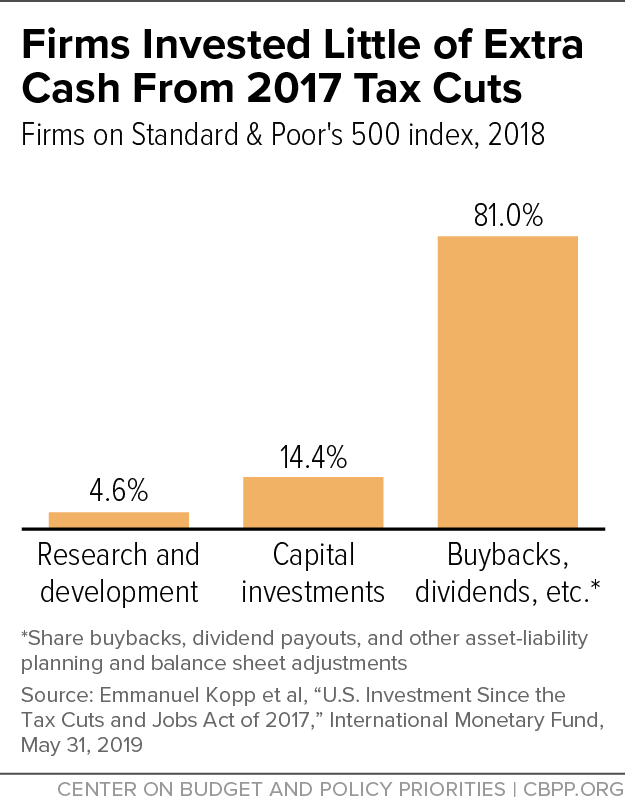

President Joe Biden called for the US. This option would increase the corporate income tax rate by 1 percentage point to 22 percent. The centerpiece of the 2017 law was a corporate tax rate cut from 35 to 21 percent and a shift towards a territorial tax system in which the foreign profits of US-based.

22 hours agoHe says the changes will still leave the UK with the most generous tax-free allowances of any G7 country adding that tax take will increase by just 1 over the next five. Taxes paid by corporations and income inequality are both topics of national attention particularly during the ongoing 2020 presidential campaignIncreasing the corporate.

Would Workers Benefit From A Corporate Tax Cut Not Much Tax Policy Center

The Progressive Case For Abolishing The Corporate Income Tax Milken Institute Review

Increasing The Corporate Rate To 28 Reduces Gdp By 720 Billion

2022 Tax Policy Outlook Managing Constant Change Pwc

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Biden S Corporate Rate Increase Would Raise Revenue Efficiently And Progressively Tax Policy Center

The Relationship Between Taxation And U S Economic Growth Equitable Growth

A Cut In The Corporate Tax Rate Would Provide A Significant Boost To The Economy Tax Foundation

Full Details And Analysis Tax Cuts And Jobs Act Tax Foundation

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

Why Temporary Tax Cuts Won T Generate Much Growth Tax Foundation

Growth Dividend From A Lower Corporate Tax Rate Tax Foundation

Tax Reform Options Comparing The Growth And Income Boosting Effects

What Are The Economic Effects Of The Tax Cuts And Jobs Act Tax Policy Center

The Benefits Of Cutting The Corporate Income Tax Rate Tax Foundation

Effects Of Income Tax Changes On Economic Growth Penn Wharton Budget Model

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

The Tcja 2 Years Later Corporations Not Workers Are The Big Winners Center For American Progress

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)